What’s New: With the curtain falling on the Fed’s QE. let’s take a look at what’s been happening of late for US Treasuries. The yields on the 10-, 20- and 30 year Treasuries have generally trended downward since the end of 2013.

The latest Freddie Mac Weekly Primary Mortgage Market Survey last Thursday puts the 30-year fixed at 3.92%, well off its 4.53% 2014 peak during the first week of January and its lowest rate since June 2013.

Here is a snapshot of the 10-year yield and 30-year fixed-rate mortgage since 2008.

A log-scale snapshot of the 10-year yield offers a more accurate view of the relative change over time. Here is a long look since 1965, starting well before the 1973 Oil Embargo that triggered the era of “stagflation” (economic stagnation with inflation). I’ve drawn a trendline connecting the interim highs following those stagflationary years. The red line starts with the 1987 closing high on the Friday before the notorious Black Monday market crash. The S&P 500 fell 5.16% that Friday and 20.47% on Black Monday.

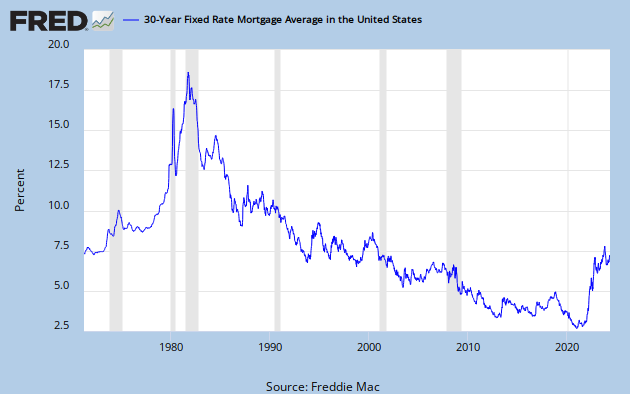

Here is a long look back, courtesy of a FRED graph, of the Freddie Mac weekly survey on the 30-year fixed mortgage, which began in May of 1976.

A Perspective on Yields Since 2007

http://www.advisorperspectives.com/dshort/updates/Treasury-Yield-Snapshot.php

Related Posts

- 81The Federal Reserve holds its last policy meeting of the year on Tuesday and Wednesday, resulting in plenty of material to be scoured for clues about when interest rates will start inching up. The central bank’s policy committee releases its statement and new economic projections at 2 p.m. Wednesday, followed…

- 73Several Fed Officials Said Forecasts Overstated Rate Rise Meeting minutes revealed that in March, Fed Reserve policy makers discussed that a rise in their median projection for the main interest rate exaggerated the likely speed of tightening. Treasury yields rose last month after policy makers predicted that the benchmark interest…

- 62The Federal Open Market Committee releases minutes from its last meeting on Wednesday afternoon, but Wall Street is already downplaying the event as a sideshow in comparison to an annual symposium on monetary policy in Jackson Hole, Wyoming, two days later. "The FOMC minutes are telling us about what happened…

- 61Imagine Fed Governor Rip van Winkle started his nap at the beginning of 2007 and just woke up to find that inflation is close to the Fed’s objective and the unemployment rate is at its 30-year average. You could forgive him for expecting the federal funds rate to be close…

- 61Here’s what to look for from the Federal Reserve Bank of Kansas City’s annual economic symposium in Jackson Hole,Wyoming, which runs Aug. 21-23. -- Yellen’s keynote: The highlight will be Fed Chair Janet Yellen’s speech Aug. 22 on labor markets at 10 a.m. New York time. She’ll probably reiterate the Fed’s view…