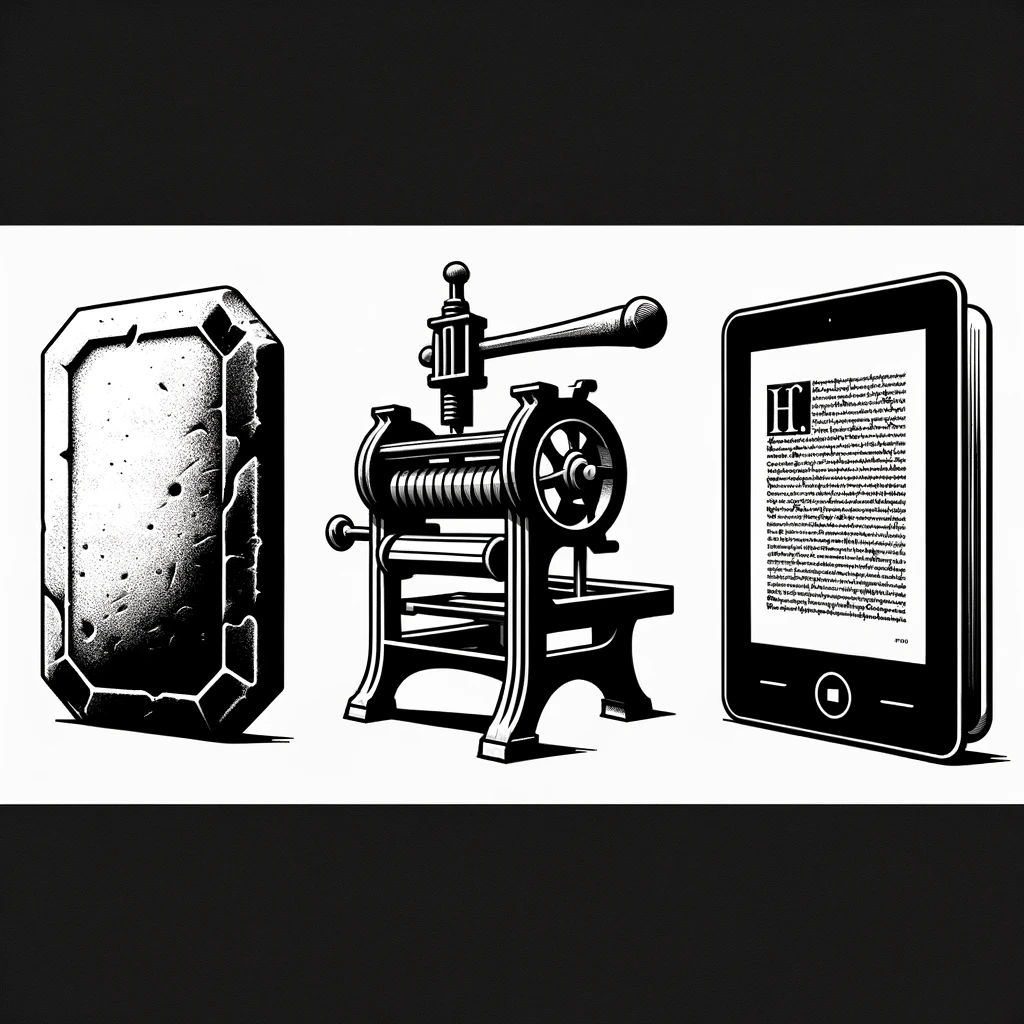

The history of books and bookstores is as rich and diverse as the myriad of stories and ideas they contain. From ancient times, when the written word was first etched onto clay tablets, papyrus, and parchment, to the modern era of digital books and online retailers, the journey of books and bookstores through the ages is a fascinating tale of human endeavor, intellectual progress, and cultural evolution.

The Ancient Origins

The story of books begins in the ancient world, where civilizations like the Sumerians, Egyptians, and later the Greeks and Romans, developed writing systems to record laws, religious texts, and literature. The earliest forms of books were clay tablets in Mesopotamia and scrolls made from papyrus in Egypt. These ancient texts required laborious efforts to create and were highly valued.

The Birth of the Codex and the Rise of Libraries

The codex, the precursor to the modern book, emerged in the Roman Empire. Made of parchment or vellum, these were the first instances of books as we recognize them today, with bound pages. This period also saw the establishment of libraries, such as the Library of Alexandria, which sought to gather all human knowledge under one roof. However, books were still painstakingly copied by hand, making them rare and expensive commodities.

The Middle Ages and the Monastic Scriptoria

During the Middle Ages, the production of books became the domain of monasteries. Monks worked in scriptoria to copy and illuminate manuscripts, preserving religious texts, classical works, and new scholarly writings. This era saw the rise of universities, which further fueled the demand for books and led to the emergence of stationary shops, the precursors to modern bookstores, where scholars could purchase texts.

The Gutenberg Revolution

The invention of the printing press by Johannes Gutenberg in the 15th century was a pivotal moment in the history of books. The Gutenberg Bible, printed around 1455, demonstrated the power of movable type. This innovation drastically reduced the cost of book production, making books more accessible to a broader segment of society and leading to a significant increase in literacy rates. It also laid the groundwork for the emergence of bookstores as we know them today.

The Flourishing of Bookstores

By the 17th and 18th centuries, bookstores had become common in Europe. They were not only places to buy books but also hubs of intellectual and social activity. Famous bookstores like Shakespeare and Company in Paris, founded in the 20th century, became meeting places for writers, artists, and thinkers. The 19th and 20th centuries saw the expansion of the publishing industry and the proliferation of bookstores around the world, catering to an ever-growing audience of readers.

The Modern Era and the Digital Age

The late 20th and early 21st centuries have witnessed the evolution of bookstores in the face of digital technology. The rise of the internet and e-books has transformed how people access and read books. Online retailers like Amazon have changed the retail landscape, while traditional bookstores have adapted by creating spaces for community events, readings, and cafes, emphasizing the experiential aspect of book shopping.

Despite these changes, the essence of bookstores as sanctuaries of knowledge, culture, and community remains unchanged. They continue to be places where ideas are shared and discovered, where stories come to life, and where the intellectual and creative spirit of humanity is celebrated.

The history of books and bookstores is a testament to the enduring power of the written word. It reflects our constant desire for knowledge, our creative spirit, and our need to connect with others through stories and ideas. As society evolves, so too will the ways in which we produce, distribute, and consume books, but their significance as carriers of culture, knowledge, and imagination will undoubtedly endure.

The importance of books in acquiring knowledge has been a subject of study and recognition for centuries. Books are not just vessels of stories and ideas; they are the backbone of learning, the foundation of civilizations, and the catalysts for intellectual progress and personal growth. Through books, knowledge is preserved, shared, and expanded, bridging cultures, epochs, and perspectives. This essay explores the multifaceted role of books in knowledge acquisition, supported by studies and theoretical insights.

Historical Perspective

Historically, books have been at the forefront of educational systems, serving as primary sources of knowledge across various subjects. From the ancient libraries of Alexandria and Nineveh to the modern digital libraries, books have been instrumental in preserving human knowledge and culture. The invention of the printing press in the 15th century by Johannes Gutenberg revolutionized the dissemination of knowledge, making books more accessible and affordable, which, in turn, played a crucial role in the spread of literacy and education.

Cognitive Development

Studies in cognitive psychology and education have shown that reading books significantly impacts cognitive development, including memory, concentration, and critical thinking skills. According to a study published in the journal “Science” (2013), reading literary fiction improves theory of mind, the ability to understand others’ mental states, which is a key skill in developing empathy and social reasoning. This suggests that the benefits of reading extend beyond acquiring factual knowledge, influencing cognitive and emotional intelligence.

Knowledge Acquisition and Retention

Books offer a deep, immersive experience that other media cannot replicate. Reading allows for reflection, analysis, and synthesis of information, facilitating a deeper understanding and retention of knowledge. A study by the Association for Psychological Science (2012) found that reading comprehension and recall are higher when reading from paper compared to screens, highlighting the enduring value of printed books in learning environments.

The Role in Academic Success

The correlation between book reading and academic success has been extensively documented. A report by the Organisation for Economic Co-operation and Development (OECD) found that students who are avid readers perform better academically across all subjects, including mathematics and science. Books expose students to a wider vocabulary, complex sentence structures, and diverse ideas, enriching their academic skills and intellectual horizons.

Accessibility and the Digital Age

The advent of digital books and online resources has transformed access to knowledge, democratizing information like never before. E-books and online libraries make it possible for individuals from all walks of life to access vast repositories of knowledge without the constraints of physical space or resources. This digital shift, while changing the traditional book landscape, underscores the enduring importance of books in knowledge acquisition, adapting to meet the needs of contemporary learners.

Conclusion

The role of books in acquiring knowledge is both timeless and evolving. Whether in print or digital form, books remain fundamental to learning, offering depth, reflection, and a unique engagement with ideas. Studies across cognitive science, education, and sociology continue to affirm the critical role of books in cognitive development, academic success, and lifelong learning. As we navigate the complexities of the modern world, the intrinsic value of books in fostering informed, thoughtful, and empathetic individuals cannot be overstated. In the words of philosopher Francis Bacon, “Reading maketh a full man; conference a ready man; and writing an exact man.” Books, in their myriad forms, continue to be the cornerstone of personal and intellectual development, embodying the collective wisdom, imagination, and curiosity of humanity.

Related Posts

- 62This compendium of wisdom emphasizes respect, integrity, self-improvement, and happiness, drawn from literature on human behavior and growth. Advocating respectful interactions, trustworthy conduct, and acts of generosity, it also highlights the importance of passion, goal-setting, nurturing relationships, mindful self-care, social etiquette, and lifelong learning. Ultimately, it invites us to live…

- 61In "Mastering the Mental Game of Trading," the book emphasizes the importance of risk management and psychological resilience for trading success. It highlights the inevitability of financial setbacks, underlining that mastering risk, rather than avoiding mistakes, differentiates exceptional traders. Through introspection and expert anecdotes, the book guides traders to refine…

- 50We caught up with billionaire entrepreneur and investor Mark Cuban during South by Southwest Interactive in Austin. Our first question: what apps does the "Shark Tank" star and Dallas Mavericks owner have on his smartphone? Read more: http://www.businessinsider.com/mark-cuban-13-apps-phone-2014-3#ixzz2wLaru5Rl

- 50Thanks to PricewaterhouseCoopers’ (PwC) 2014 report on Cities of Opportunity, job seekers have a handy list of some of the best cities to find a job across the world. Using 10 indicators to look at the factors that contribute to a well-balanced city, the study compared 30 different cities and…

- 49Jeff Bezos, John Henry, Warren Buffett, they are good businessmen. If they are such bad deals, why do good businessmen want them so badly? Warren Buffett loves newspapers. He's not looking to change the newspaper business, ditto for John henry. But Jeff Bezos wants to experiment. He wants to shift…