The population of Greece is slightly less than the state of Ohio’s, while its gross domestic product is just a little bit bigger than the economies of Kazakhstan, Algeria and Qatar.

Instead of focusing on Athens, investors should be much more worried about what’s going on in China. You know, that country with about 1.4 billion people and the world’s second largest GDP?

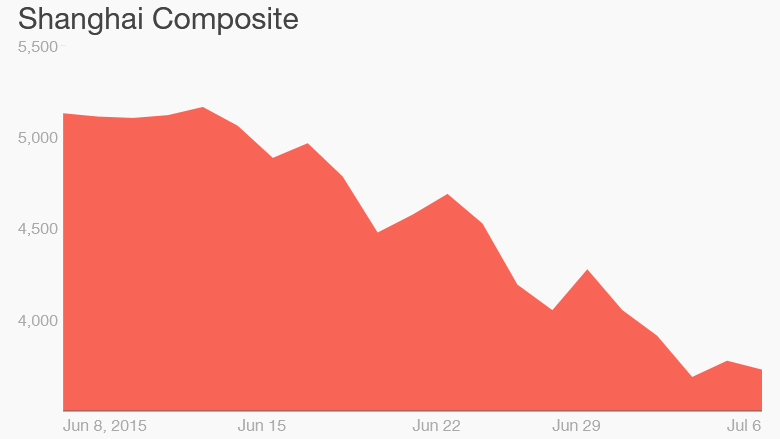

The Shanghai Composite and Shenzhen Composite have both plunged about 30% from their highs due to legitimate concerns that Chinese stocks are in a bubble.

China’s government is taking steps to try and minimize any more pain in the market. But that could backfire.

Regulators announced Sunday that they would make more capital available for an entity that will allow for even more margin lending, the practice of borrowing money to buy stocks. Buying on margin is incredibly risky.

Many experts believe the Chinese stock market’s surge earlier this year was partly due to average investors taking on debt to invest in stocks.

And when stocks first started to fall last month, many of those investors had to quickly sell their investments to pay back the loans. That fueled an even bigger drop in stock prices.

It could get worse as investors realize that the slowdown in China’s economy should hurt corporate profits.

“Exuberance for Chinese stocks isn’t backed up by fundamentals,” said Michael Pento, president and founder of Pento Portfolio Strategies, in a report Monday morning. “Instead, it appears markets are being levitated by continued government borrowings and manipulations.”

A move by big Chinese brokerage firms to keep buying stocks until the Shanghai Composite reaches a certain value could also be a problem.

Lei Mao, an assistant professor of finance at the Warwick Business School in the United Kingdom, worries that the government may be inflating the value of larger companies at the expense of many smaller firms.

To that end, the Shanghai Composite, which is home to many larger, established Chinese companies, did rise more than 2% Monday. But the Shenzhen, which is where younger, riskier tech stocks tend to trade, fell nearly 3%.

“These distortions, in today’s market, create a significant flow of funds to large state-owned companies – a ‘flight to state’. Plus they might create the reasons for another free-fall in the near future,” Mao said.

Why does this matter to people outside of China? A rapidly sinking stock market is often a sign of an economy in turmoil. Remember 2008? And 2000?

Since China is the second largest trading partner for both Europe and the United States, it goes without saying that a healthy Chinese economy is good news for the developed world.

All that talk about the possibility of Greek contagion if it is forced to drop the euro and bring back the drachma? That seems overdone too.

Economists at the Royal Bank of Scotland tweeted out a chart last week that showed that U.S. banks have nearly ten times as much exposure to China than Greece.

And Kathleen Brooks, a research director for FOREX.com, wrote in a report Monday that “sentiment could suffer across the Asia region and further afield” if China is unable to stop the bleeding in its stock market.

China is a massive consumer of commodities as well.

Oil prices dropped Monday — and while many were quick to blame Greece and the drop in the euro, that doesn’t make that much sense when you think about it.

“Look at the stories written about the drop in the price of oil today, and they’ll be talking about how the demand for oil drops because of Greece,” said Chuck Butler, managing director of EverBank Global Markets, in a report Monday. “I have to think that’s a bunch of bunk. China? Yes. Greece demand? No!”

Of course, you can’t ignore Greece entirely. But don’t get too caught up with the latest headlines from Europe either. China matters a lot more to the global economy — and your portfolio.

Related Posts

- 64The global financial crisis did not start in 2008 but in 2007 when BNP Paribas and UBS AG suspended withdrawals from some of their funds. If the world is once again buffeted by a similar crisis thanks to the enormous splurge in Chinese lending and fears about the quality of…

- 60The yuan has recently been something of a safe haven among emerging-market currencies, yet market participants have learned from a bloody lesson over the past week that it is no longer an easy, one-way bet. A sharp fall of both the onshore and offshore yuan against the greenback made the…

- 58For 31-year old Beijing resident Wang Yuanzhi, talk about a bubble in Chinese property is not something to be too concerned about. "If you look at the real estate market in China, it has already seen a golden decade of extreme fast growth. There will still be room for growth…

- 5611 Ugly Charts That Confirm China's Dramatic Slowdown During the National People's Congress, China's policymakers announced that it would target 7.5% GDP growth target for 2014. This is down from 7.7% growth in 2013, and the recent data shows that the economy is clearly off to a slower start to…

- 56This week marks the centenary of the assassination of Archduke Franz Ferdinand of Austria - the key trigger for WWI leading to a conflict between European powers soon enough. A hundred years later, the world has similar echoes of the early 20th century with a major shift in global power…