The hedge fund industry used to have humble beginnings: in 1990, it had $40 billion in assets under management. Now, its growing appeal has led to a staggering $2.6 trillion in 2013. In retrospect with the mutual funds industry and the global financial markets, this is a small figure. However, there has been tremendous growth in the hedge fund industry, with an estimated 10,000 active funds today[1]. The most initial hedge fund was started by Alfred W. Jones in 1949, who used a combination of leverage and short selling to hedge against the market risk. In spite of his success, hedge funds gained real prominence in the 1960s. This was when major investment names like Warren Buffet and George Soros implemented Jones’s strategy. As a result, the figure of new hedge funds has grown despite the alarming 10 percent of hedge funds shutting down each year due to a host of reasons such as unsatisfactory performance or inability to raise adequate funds.

Hedge funds not unlike real estate and private equity investments are perceived to generate high returns that are not related to traditional investments; this is what attracted many investors and institutions towards hedge funds. Nowadays, the hedging strategies used have become more complex, sophisticated and accurate, as compared to the short selling and leveraging techniques used initially. However, in the year of 2008, the hedge fund industry faced a great hit in its popularity as numerous successful investors and institutions incurred heavy losses of around 30 percent and more. As a result, the assets under management dwindled as the investors selected treasury bills and cash investments, which were deemed much safer than hedge fund investments. Fortunately, the advanced hedge fund strategies employed rendered attractive returns in the precarious market, which helped regain some of the lost charm of hedge funds. In 2009, the situation improved and hedge funds regained popularity.

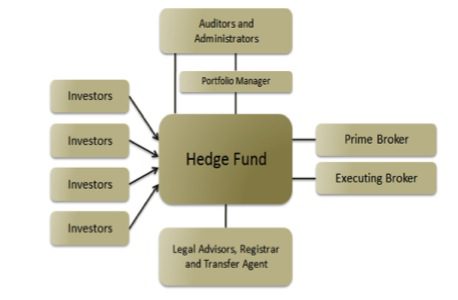

Most hedge funds are extremely specialized and rely upon the specific expertise and skill of the management or fund managers. These managers make use of a variety of investment strategies, which will be elaborated on later. They specifically try to minimize the market risk by shorting equities and/or using derivatives. Since the hedge funds make use of sophisticated investment strategies, their returns have tended to outperform standard equity and bond indexes for a number of years, with not only less volatility but also less risk of loss as opposed to equities. This is why usually many endowment funds, pension funds, private banks, and high net worth people indulge in hedge funds. However, the main investors in the hedge fund industry are usually state and municipal pension plans, corporate pension plans, and universities endowment. The key players within the hedge fund industry can be explained via the following diagram:

Source: Managed Funds Association

Portfolio managers identify the strategy and are usually invested in the hedge fund themselves; however, they are compensated according to the fund’s annual performance. The prime brokers secure their loans with collateral to generate margin and secure trades. As a result, each broker (typically in a large securities organization) employs their own risk matrix to assess how much to lend to each client as they act as a stand-in regulator. On the other hand, auditors are the ones who ensure legal fund compliance and verify financial statements as per the federal law[2]. Hedge funds are regulated and registered by the United States Securities and Exchange Commission (SEC) in the US and are subject to certain trading regulations as well as outlined by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, in order to ensure that what happened in 2008 is not repeated.

In spite of the scrutiny the hedge funds are under, the industry has grown. This is particularly due to the fund of fundsdevelopment, which is a mutual fund that is able to invest in multiple hedge funds. This enabled investors to have a more diversified portfolio and a lower minimum investment requirement that went as low as $25000. The fund of funds feature led to a proportion of the risk being taken out of the hedge fund investment and also made it possible for average investors to invest in the hedge funds as well, unlike before.

Source : http://www.hedgethink.com/industry/guide-hedge-funds-branding-part-2-introduction-industry/

Related Posts

- 96What is a Hedge Fund? A hedge fund is an aggressively managed investment fund that is maintained by a professional management firm. Hedge funds are typically a portfolio of investments that makes use of advanced and complex investment strategies like short and long positions, leveraged positions, arbitrage, and derivative positions…

- 92Czech Republic wants a piece of the rising hedge fund industry, after a new EU regulation named AIFMD (Alternative Investment Fund Manager Directive) takes effect in July. Previously the highest number of hedge funds, after the U.S., are domiciled in Luxembourg, a tiny EU state. But the new EU rules, which…

- 78In 1992, George Soros brought the Bank of England to its knees. In the process, he pocketed over a billion dollars. Making a billion dollars is by all accounts pretty cool. But demolishing the monetary system of Great Britain in a single day with an elegantly constructed bet against its currency?…

- 78Examining the HSBC Hedge Weekly voluntary performance update, it appears certain hedge funds, after some of the most volatile markets in years, have not been quick to post their performance, while others, such as Roy Niederhoffer, have enjoyed the recent market volatility. Hedge funds: Greenlight and Glenview hedge funds slow to…

- 77Commodity Futures Trading Commission data show the most-bullish six-week change to Aussie positions in more than 1 1/2 years over the period to April 22, just in time to catch a slump that made the local dollar the past week’s worst performer among 10 currencies tracked by Bloomberg Correlation Weighted…