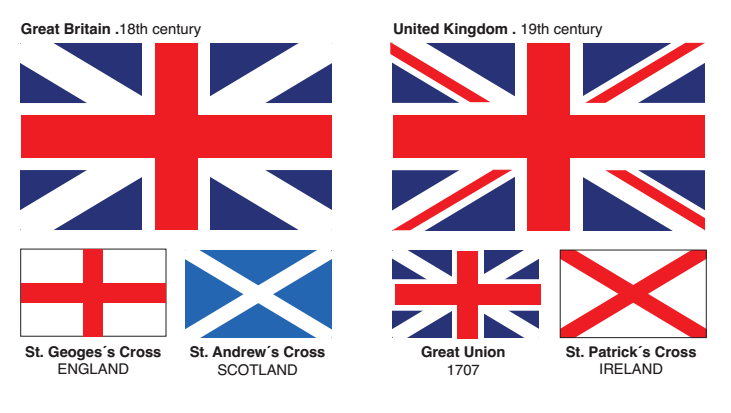

Sterling markets are stirring on the risk of the U.K.’s 307-year-old union splintering, and that spells danger for the pound.

Britain’s currency is likely to weaken when markets resume trading after the weekend, strategists said following a poll that showed the Scottish independence campaign gained a lead for the first time this year with two weeks left before the vote. The pound fell the most in 14 months last week, and gauges of future price swings surged after the previous YouGov Plc showed the “No” campaign’s lead was shrinking.

“The referendum is on a knife edge,” saidNick Stamenkovic, an Edinburgh-based fixed-income strategist at broker RIA Capital Markets Ltd. “Markets have been too complacent but are now waking up to the increased risk of Scotland voting for independence.”

Related Posts

- 74At first glance, the eurozone economy seems like it might finally be on the mend. True, according to some estimates, the eurozone economy may now be growing at an annual rate of 1.6%, up from 0.9% in the year to the fourth quarter of 2014. With the eurozone economy 2% smaller than it…

- 71The Swiss National Bank (SNB) has set a minimum exchange rate of 1.20 francs to the euro, saying the current value of the franc is a threat to the economy. http://www.bbc.com/news/business-14801324 "The Japanese example with yen intervention teaches us that intervention can work in the very short term but changing…

- 64Europe’s leaders argue that only deep budget cuts will revive the economy and inspire the necessary confidence among investors. The deal represents a major milestone for Greece, which was effectively shut out of the markets in 2010 when the debt crisis left it dependent on international bailouts to stay afloat.The…

- 64Can you guess where most Chinese nationals are in Europe ? The answer is Italy. Who lives where in Europe? Nationalities across the continent mapped People of many different countries are now living in Europe, with the continent's residents coming everywhere from Jamaica to Tuvalu. Using data from 2011 censuses we have mapped…

- 64There seems to be an obvious solution to rising inequality: higher taxes. But there's an inconvenient fact here. The way most advanced, industrial countries have made real gains on inequality is through relatively regressive taxes that fund programs that reduce inequality. In fact, America's tax system is already unusually progressive by…