The world’s next credit crunch could make 2008 look like a hiccup

Is this why central bankers are so scared of raising interest rates?

A solar eclipse, a super moon, the FTSE 100 breaching 7,000 and the US Federal Reserve speaking in tongues – truly some kind of financial apocalypse must be nigh. Well, maybe.

We are certainly living in strange times. An unprecedented monetary experiment is coming to a staggered end and no one knows the potential repercussions – a plague of frogs cannot be entirely ruled out.

For the time being, the markets remain sanguine, expecting, for example, a gentle increase in the Bank of England’s main interest rate to just 1.5pc by the end of the decade. And, who knows, maybe the markets are right.

But maybe it’s too quiet. Last week, Ray Dalio, the founder of the $165bn (£110bn) hedge fund Bridgewater Associates, wrote a widely-circulated note warning his clients that the US Federal Reserve risked setting off a 1937-style crash when it starts raising interest rates again.

Then, as now, the central bank had spent years printing money in order to help the American economy recover from the 1929 crash. But the side effect was a stock market bubble, which promptly burst when the Fed prematurely increased rates. Mr Dalio is worried about a repeat performance: “We don’t know – nor does the Fed – exactly how much tightening will knock over the apple cart.”

It’s true that the policy and regulatory response to the last crisis often sows the seeds for the next. It is not hard to map out a sequence of events in which that proves to be the case again. If it were, a US stock market crash might be the least of our problems.

In 1937 the US was, economically speaking, an island, entire of itself; today, thanks to globalisation, the power of the dollar and a long period of ultra-loose monetary policy, it is a part of the main.

Christine Lagarde, the head of the International Monetary Fund, recently raised concerns in India about the ripple effect of Fed tightening on countries that have borrowed heavily in dollars and whose still-recovering economies remain vulnerable to a rate rise.

And in 1937 the equity markets were the financial be-all and end-all; today they are dwarfed by the debt markets, which are, in turn, dwarfed by the derivatives markets.

The total value of all global equities was around $70 trillion in June last year, according to the World Federation of Exchanges; meanwhile, the notional value of all outstanding derivatives contracts was more than $690 trillion. It is worth noting that the vast majority (around four-fifths) of all existing derivatives contracts are based on interest rates.

The derivatives market is the not the vast roulette table of popular perception. These financial instruments are essentially insurance policies – they are designed to protect the holder from adverse price movements.

If you are worried about (to pick some unlikely examples) a strong euro, or expensive oil, or rising interest rates, you can buy a contract that pays out if your fears are realised. Managed well, the gain from the derivative should offset the loss from the underlying price movement.

Related Posts

- 62When the banking crisis crippled global markets seven years ago, central bankers stepped in as lenders of last resort. Profligate private-sector loans were moved on to the public-sector balance sheet and vast money-printing gave the global economy room to heal. Time is now rapidly running out. From China to…

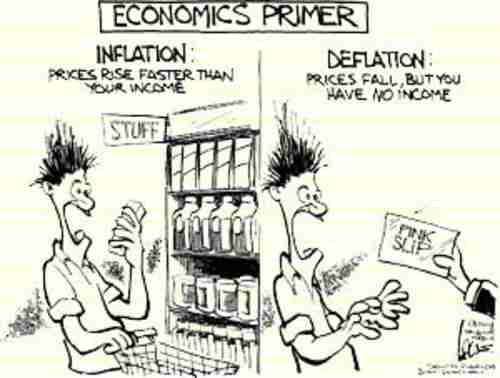

- 56(Source http://www.independent.co.uk/news/business/comment/david-blanchflower/david-blanchflower-we-should-fear-deflation--not-welcome-it-9986726.html ) The UK isn’t in deflation yet. While central bankers know what to do about stopping inflation, they don’t know what to do about halting deflation. The Swiss National Bank last week abandoned its attempt to defend a currency floor, which caused a sharp appreciation in its currency, which…

- 55Coal accounts for approximately 40 percent of all electrical generation on the entire planet. When the price of coal starts to drop, that is a sign that economic activity is slowing down. Just prior to the last financial crisis in 2008, the price of coal shot up dramatically and then…

- 55Source : http://www.alhambrapartners.com/2015/08/14/the-dollar-run-hits-the-corporate-bubble/ The ‘Dollar’ Run Hits The Corporate Bubble by Jeffrey P. Snider in Bonds, Currencies, Economy, Federal Reserve/Monetary Policy, Markets Tags:asian flu, asset bubbles, china, convertibility, corporate bond bubble, dollar run, eurodollar standard,global recession, high yield, interbank, junk, leveraged loans, Repo, wholesale funding, yuan By the behavior of…

- 55On Tuesday, Federal Reserve Chair Janet Yellen promised the House Financial Services Committee "a great deal of continuity" in monetary policy as she fills the shoes of Ben Bernanke. However, Yellen is not Bernanke. And depending on her read on the economy, she will use her powers to influence…

/cdn0.vox-cdn.com/uploads/chorus_asset/file/2397824/USA-Franklin_Delano_Roosevelt_Memorial.0.jpg)